Dairy analogues: are they becoming

Dairy analogue, market scope and consumer drivers

The dairy analogue market in facts

The market for non-dairy alternatives represents a huge opportunity. The global dairy analogues market is predicted

to grow from $22 billion in 2022 to $31 billion in 2027 at a CAGR of 8% over the forecast period [Euromonitor 2022].

In addition, the segment is enjoying strong innovation with the regular development of new products such as plant-based creams and creamers.

Market segmentation mimicking the dairy market segmentation:

Dairy analogues include all food products that emulate animal dairy products by replacing dairy proteins with plant bases. This emulation leads to similar product formats and thus a similar market segmentation as the dairy market, with plant-based products such as:

New categories are constantly being created, driven by strong innovation in the sector and the launch of new products such as liquid cream substitutes, cream powders, whipped toppings, and even sour cream that can replace dairy-based ingredients in recipes.

5 categories of plant sources

Coconut, soy, almonds, and oat are the most popular sources for dairy analogues, however, continued innovation to meet growing consumer demand means that the raw materials used for dairy alternatives are diversifying.

There are 5 main categories of sources for dairy alternatives

[Sethi et al, Journal of Food Science and Technology, 2016 (and multiple sources)]

Cereal based

e.g., oat, rice, corn, and spelt.

Legume based

e.g., soy, peanut, lupin, and cowpea.

Nut based

e.g., almond, coconut, hazelnut, pistachio, and walnut.

Seed based

e.g., sesame, flax, hemp, and sunflower.

pseudo-cereal based

e.g., quinoa, teff, and amaranth.

Asia shows the most frequent use of dairy alternatives

The consumption and use of plant milk is nothing new – plant-based milks have been a staple part of many people’s diets around the world for hundreds of years. Coconut milk is one of the main ingredients in Southeast Asia, South Asia, the Caribbean and northern South America, and has been used for cooking in India for millennia

[Vegan Food & Living, 2018 (and multiple sources)].

Did you know?

Soya milk is first mentioned in written Chinese texts in 1365 and was brought to Southern Europe more than 1,000 years ago, while almond milk was used as a therapeutic beverage or food ingredient in Christian and Islamic cultures in the Middle Ages [Milk: Origin and meaning of milk. Online Etymology Dictionary, 2018 (and multiple sources)].

Health concerns drive consumer demand

Plant-based eating is an increasingly strong trend moving from a niche to a mainstream category, especially in Western countries. [Innova 2021]

Flexitarianism represents one of the fastest-growing lifestyle movements. In 2020, 23% of consumers across Europe considered themselves flexitarians. Even though vegetarians and vegans still represent a small proportion of consumers – their growth is fast. Between 2016 to 2021, the number of consumers who considered themselves vegan doubled.

[Veganz Nutrition reports, 2021]

Surprisingly 38% of global consumers claim that health is the key reason for consuming dairy alternatives

[Innova Meat, Dairy & Alternative protein survey, 2021].

More specifically, digestive health is commonly cited by consumers as a reason for adopting a dairy-free diet, with lactose sensitivity/intolerance a growing problem around the world.

About 65% of the adult human population is considered to suffer from some form of lactose intolerance

[World Population Review, 2022].

According to the same study, other main reasons for adopting plant-based dairy products include sustainability and environmental concerns (18%), and ethical reasons (10%). [Innova Meat, Dairy & Alternative protein survey, 2021]

Younger generations, such as Generation Z and Millennials, are the most active consumers when it comes to plant-based dairy.

Milk alternatives – The largest dairy analogues sub-segment

Non-dairy milk alternatives lead the way in the dairy-alternative segment, accounting for 88% of the global dairy analogue market by revenue in 2022. Soy milk led the market with a 37% share of global revenue, followed by milk made from almonds, coconut, rice and oats. [Euromonitor, 2022].

Asia Pacific dominates the milk alternatives market, accounting for 40% of global sales in 2020. Non-dairy milk has been used for millennia in this region, both as a beverage and as a food ingredient, and accounts for more than 66% of total animal- and plant-based milk sales in the Asia Pacific territory. [GrandViewResearch, 2020].

Traditional dairy companies adapt their offerings to meet consumer demand for plant-based alternatives, sparking innovations in the milk alternative category, and beyond.

Cheese analogues represent the most dynamic plant-based sub-category

The cheese analogue market in facts

The global plant-based cheese market size was valued at $850 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2022 to 2027. The Western Europe leads in value. Cheese analogues is one of the fastest-growing category, with a 609 products launches in 2022. [Euromonitor, 2022]

3 main cheese analogues formats

Manufacturers aim to mimic traditional dairy cheese formats to appeal to consumers – resulting in three main types of cheese analogues:

Emmental, Gruyere, Gouda, Cheddar, Parmesan, etc.

Ideal for grating.

Mozzarella, Harvati, Fontina, blue cheese, Camembert, etc.

Great for melting.

Cottage cheese, cheese spread, Ricotta, cheese cruds etc.

Spreadable.

Coconut, the most widely used plant base

Coconut was the main ingredient used in 69% of new product launches (NPLs) in 2020, followed by potato (39%) and cashew (20%) – although many cheese analogues use a blend of 2 or 3 plant bases.

Creating Plant-Based Cheese – The Challenges

One of the main challenges for R&D is to produce cheese analogues with a variety of cheesy tastes and textures, and with the ability to melt, to make them more appealing to consumers. Manufacturers also need to control specific off-notes – linked to the plant base and the nature of the ingredient.

Take cheese analogues to the next level with Biospringer yeast-based solutions

Yeast-based ingredients: supporting innovation in non-dairy cheese

The properties of yeast open a whole world of possibilities.

Yeast-based ingredients provide a natural solution to some of the challenges outlined above, particularly when it comes to nutrition and building complex and intense taste, and so are becoming helpful ingredients in the development of cheese substitutes.

The composition of yeast-based ingredients is naturally complex, and they are rich in taste components such as proteins, amino acids, and nucleotides – which explains the great taste diversity and intensity of yeast-based ingredients. They offer multiple benefits: highlight tastes and flavors, bring umami taste, contribute to salt reduction, mask off-note flavors, and more.

Using them in different combinations offers almost limitless possibilities for building savoury, complex and rich flavour profiles.

Biospringer: experts in yeast and taste for over 150 years

Founded in 1853, at Biospringer we’ve specialized in yeast-based ingredients, including yeast extracts. We are recognized globally for our experience of fermentation and taste – through our expert teams of technologists, flavorists and expert tasting panels.

We operate a worldwide network of Culinary Centers, R&D and Sensory Analysis experts to support our customers. We are wholly committed to meeting both consumers’ and producers’ expectations by guaranteeing high-quality yeast-based ingredients for the development of innovative cheese analogue products that meet all current natural, vegan and clean label food trends.

Overcome the challenges of creating satisfying cheese analogues with Biospringer yeast solutions

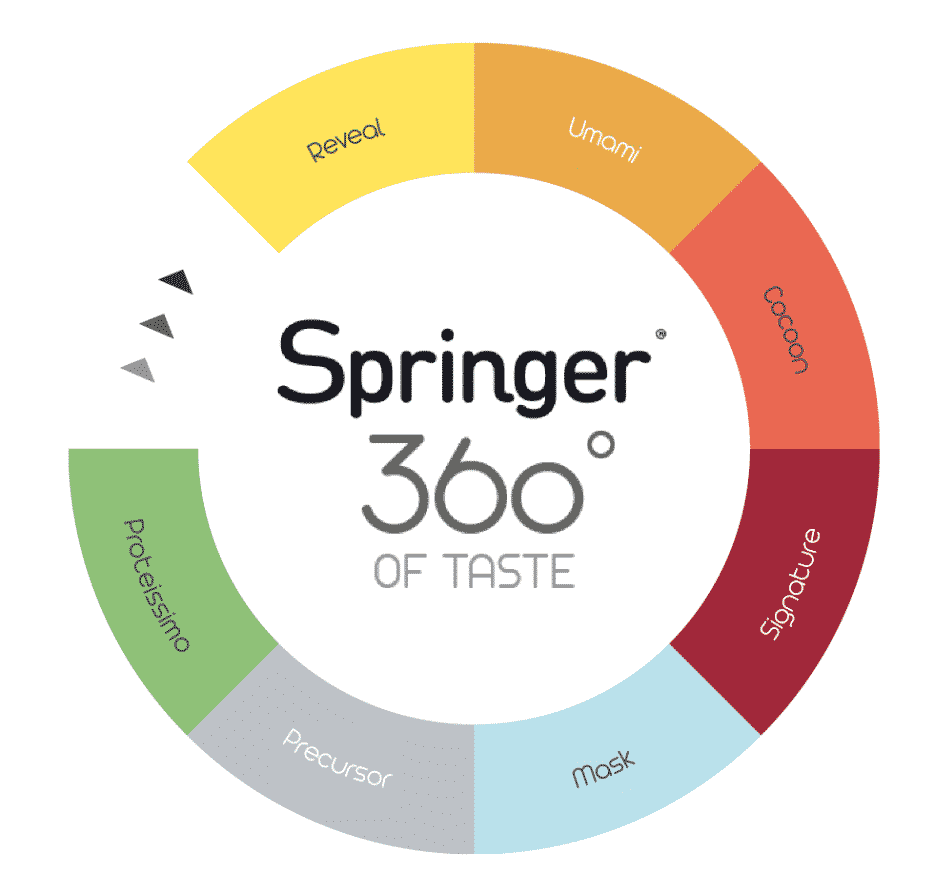

The Biospringer 360° Wheel of Taste offers 7 key ranges for food and beverage formulators, offering a variety of complementary taste benefits that contribute to developing flavourful cheese analogues.

Take cheese analogues to another level with Biospringer yeast-based solutions

Strong taste improvement tools:

Intensify cheese flavors and mimic more “matured” cheese profiles with Springer® Reveal

Bring Umami taste to increase the flavor impact and long-lasting sensation with Springer® Umami

Create an authentic and subtle cheese profile with Springer® Signature

Mask or reduce off-note flavors with Springer® Mask

Efficient contributions to a more balanced nutritional profile

Improve protein content without impacting the taste profile and improve meltability with Springer Proteissimo™

Reduce salt content while preserving taste intensity with Springer® Reveal or Springer® Umami

Products with a purpose:

Biospringer’s commitment to innovation

Biospringer’s products are innovative, consumer-oriented, and can be used in all types of food applications: food and beverages, dairy alternatives and meat analogues, and sweet and savory recipes.

- Great taste, texture, aroma, and appearance

- Relatively low processing

- Texture & Melting properties

- High protein content

- No allergens or GMOs

- Short and similar ingredient list

- Low environmental impact

Great taste, texture,

aroma, and appearance

The complexe and unique composition of yeast will intensify and bring harmony.

Combined with the expertise of Biospringer, yeast-based ingredients offer infinite possibilities in terms of taste > Intensifying cheese profile (Springer® Reveal), bringing umami (Springer® Umami), specific cheese flavor notes (Springer® Signature)

Relatively

low processing

Simple process made of only 3 steps:

fermentation, breakage and separation

High protein

content

Innovative source of protein, is a Springer Proteissimo yeast protein and contains 70% of protein contribuin.